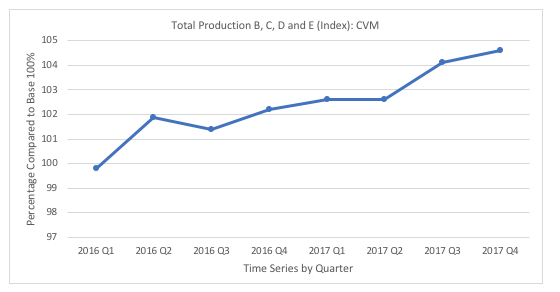

The economic picture for Britain remains chequered with interest rate rises anticipated and seemingly baked into market expectations, major logistics players on-boarding new contracts and not performing to expectations. Britain still has credibility in the world as a centre for commerce, and Total Production output grew in 2017 by 2.1% over 2016, so there are still some things to be optimistic about (see chart 1).

Chart 1: Total Production B, C, D and E (Index): CVM – Source: Office For National Statistics

There are now less than 400 days until Britain formally leaves the EU on 29th March 2019 and with many debates still raging on about what will or won’t happen. The usual position within the logistics sector was always if in doubt do nothing, which given the Brexit argument could be very worrying. We reflect on a couple of the potential big-ticket areas within logistics and the potential effects.

Border Controls

Probably the first question to address in this section is who pays for the border controls when and if established? A good guess would be that the consumer or tax-payer will ultimately foot the bill through higher prices or taxes.

With many firms operating on a just in time delivery basis, any additional border controls will likely create delays to shipments, even 15 minutes of delay could cause major expense if production or sales cannot be met.

We could find timings don’t allow for efficient truck routing, making vehicle fill and capacity vital. Drop and swap operations may well increase to combat this should ferry capacity allow. It is highly likely to mean higher charges on ferry routes as they are unlikely to increase capacity immediately to meet demand. None of this is insurmountable, but it pays to have a robust plan for such eventualities to retain clients profit margins.

Operational Impacts

This is likely to impact on stock holding requirements within the supply chain to hedge against any delay or uncertainty within the supply chain and therefore an increase in stock levels, which ultimately would drive prices higher. This could be short-lived though as operators become used to the new conditions and work out continuous improvement plans to combat these delays.

If stock levels do potentially increase, additional warehousing requirements are necessary pushing rents per square foot higher as currently spare capacity sits at 6.3% under the 5-year average of 8% (according to Logistics Manager). There is also a very tight rein on speculative developments from both developers and institutional investors with speculative developments above 100,000 square feet falling over the last couple of years those that are built are in targeted high demand areas (source Logistics Manager, March 2018, page 40).

Those with land banked in and around strategic hubs locations will benefit from this scenario happening and perhaps the speculative, as well as commissioned builds, will increase, providing a positive effect through creating additional employment in the construction sector should the brakes come off.

Any delays may well lead to vehicle movements increasing. Consequently, additional CO2 emissions damaging the environment, this could be reduced by increasing trailer fill rates. It should be noted not all products will be able to achieve an increased trailer fill. Modelling tools and computer loading programs will be able to help. Practical solutions such as double-deck trailers, alternative load stacking equipment, stacking products higher and then de-topping the product at the receiving point may well prove popular solutions in the right circumstances.

Labour

EU Nationals account for approximately 10% of the UK’s HGV driver workforce and 25% of the warehouse workforce; leakage is already occurring with people returning home due to an uncertain picture. The government and EU should firm up all those EU Nationals in place before the Brexit deadline have the right to stay post, then it will be dependent upon the outcome of negotiations.

The government has said EU National HGV drivers will retain permits post Brexit which really is a necessity. This would prevent the labour pool shrinking as a country we are short on workers in transport circa 50,000 currently (according to the Freight Transport Association) and have an ageing driver workforce.

Driverless truck technology is starting to be tested, and some of the major players have forward orders for the Tesla Semi (a zero-emissions electric truck with ranges between 300 – 500 miles) it is likely to be awhile away before it is accepted and commonplace on our roads though.

It is difficult to determine if there is a shortage of labour within the warehousing sector, although automated warehouses have been around for some time the payback period is typically beyond 20 years. That is a large capital expenditure and exposure to fast-changing market conditions in which your investment could become obsolete and mean a lack of competitiveness without careful consideration.

The labour shortfall within the sector is potentially forcing prices up as employers look to incentivise workers. There are apprenticeships in place to attract young people into the marketplace, but most of the current generation fell into Logistics and it is again likely to be years before the mass benefits of these programmes come to fruition.

Summary

The ability to fully utilise trucks and turn the warehouse have always been and remain key fundamental drivers in controlling costs and being competitive.

Time is running out, many commercial contracts both home and abroad without the willingness of all parties within the tender phase will often take longer than a year to negotiate and implement.

This is where logistics procurement can help you. Pick up the phone and speak to Simon Paget, one of our Logistics expert today; can your clients afford to do nothing?