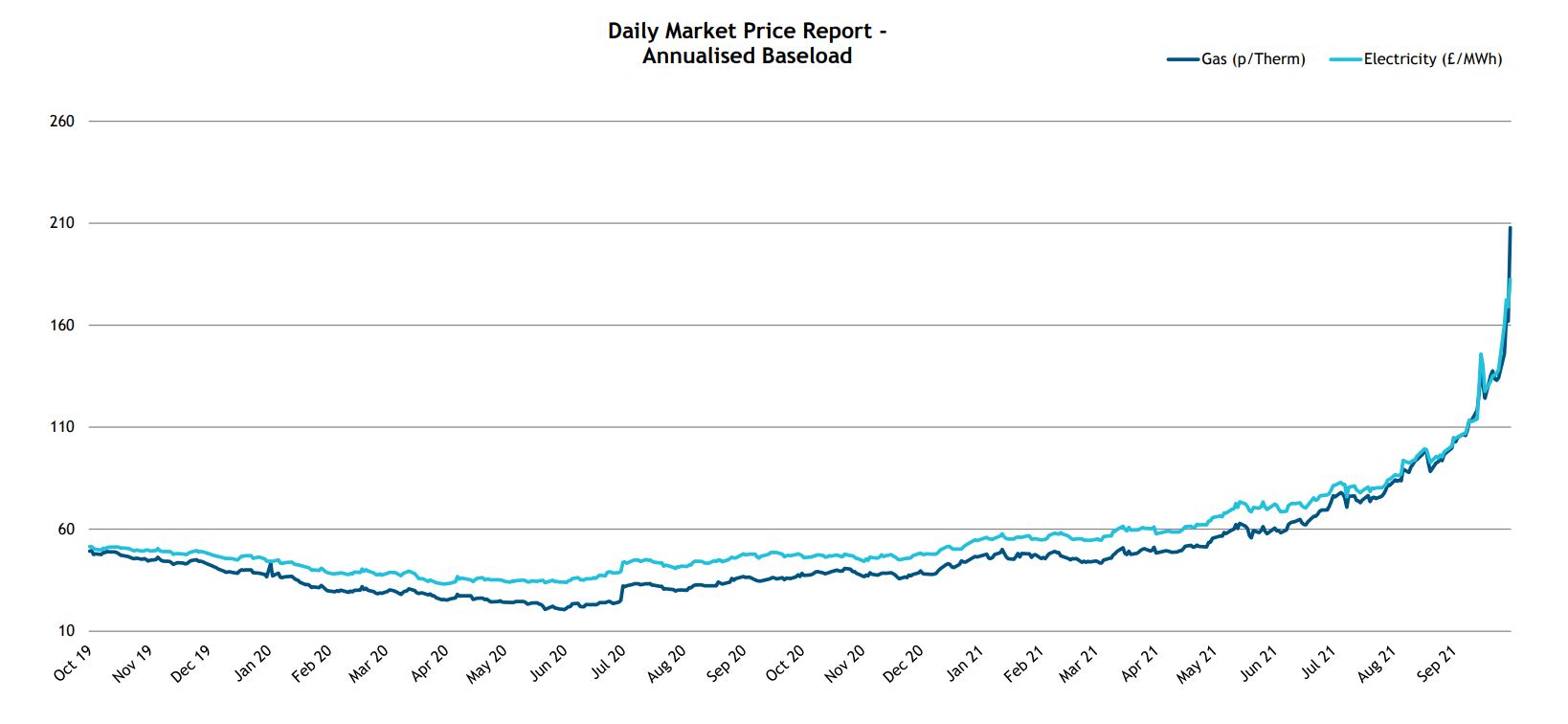

Unprecedented has become an overused word over the last eighteen months, but there is no other way to describe the machinations of the wholesale energy market. In one month alone, gas prices increased more than 70% to reach 5.89p/ kWh and electricity followed suit closing September 62.5% up at 16.59 p/kWh . (Bear in mind this is only the commodity cost which represents about 40% of the total bill for consumers).

The background to this extraordinary price rally remains the surging cost of gas occasioned by high demand for the commodity in Asia, limited flows of gas from Norway and Russia, a dearth of LNG cargoes into the UK and Europe, and a struggle to source adequate supplies to replenish gas storages ahead of the traditional “heating season”.

Coupled with these factors has been an unusually low contribution from renewable energy with one supplier (SSE) noting that their renewable assets produced 32% less power than expected during the six months April-September 21, due to historically dry and low wind conditions. Another supplier (EDF) has also revealed that five of its nuclear units are offline taking about 3000 MW out of the available generation system. By 2024 five of the UK’s eight nuclear plants will be halted permanently. These factors alone throw into sharp relief the Government’s eye catching commitment to 100% renewables by 2035. In 2020 just over 40% of our electricity demand came from renewables.

With many businesses having 1 October supply contract renewal dates there was a vain hope that the market might show some signs of easing but this has not unfortunately materialised.

In the wider energy complex Brent Crude oil prices increased 7.6% closing the month at $78.54/bbl supported by growing fuel demand as economies emerge from Covid restrictions and European carbon stepped up 1.6% to €61.92/tCO2. Once again, some mothballed coal burning assets have been reactivated to counter the high cost of gas fired power.

The Nord Stream2 gas pipeline has begun to be filled and pressurised bringing the pipeline closer to operation. The Nord Stream 2 project is designed to carry Russian gas directly to Germany and whilst operators say that gas could start flowing as early as this month the pipeline remains wrapped up in EU regulatory controversy. The US, Poland and Ukraine have lodged concerns over the NS2 operations and so what might be the only bearish factor in an otherwise surging market is by no means out of the woods.

Finally in the UK one side effect of the price surge has been the failure of nine energy companies in recent weeks leaving about 1.5m customers exposed to Ofgem’s Supplier of Last Resort mechanism. This business will comprise a mixture of domestic and commercial supplies and presents the incoming SOLR supplier with the problem of buying the energy to cover the stranded customers. At its most extreme, with the Standard Variable Tariff Cap in place for domestic customers at around £80.00/ MWh suppliers are looking at a current cost of around £250.00/MWh to cover this demand. Some larger suppliers will be forward hedged to some extent, but more failures amongst smaller suppliers are inevitable.

About the Author: Richard Clayton, started his career in procurement with Tate & Lyle Plc and after 24 years joined Expense Reduction Analysts, where his focus has been devoted to the energy market.

Whilst every reasonable care is taken in the compilation of the information contained within this page, any opinions expressed, errors or omissions are not the responsibility of the publisher.