Financial Services Solutions delivering Indirect, Procurement & Supplier Cost Optimisation

Overview

COVID-19 continues to affect most aspects of business, from the robustness of supply chains, stability of the financial markets, availability of the labour force and the threat of rapidly waning customer demand.

Many organisations across Financial Services have demonstrated a flexible and resilient response to this crisis. Business leaders have been forced to manage the movement of entire support functions to work from home, redefine processes, realign focus and reprioritise workloads to allow their people to work safely, with the tools they need to support customers. In the immediate term, these positive actions need to be refined and embedded across the organisation, to not only survive but to thrive in the future landscape.

The difficulties experienced in growing revenue streams in this environment are becoming increasingly evident, thus businesses are having to concentrate on a long-term focus to reduce costs. This is not surprising given the significant overheads of financial institutions, but it is not easy to identify the areas that can be targeted to drive efficiency without compromising client engagement or regulatory compliance.

With an impending recession and continued economic uncertainty, we hope that the following insights will help you to drive cost efficiencies, streamline processes and improve the customer experience.

Download our corporate brochure today to learn more about ERA Group and discover how we can help your organisation.

Download the Financial Services Solutions White Paper

Please enter your email address to download this file.

Introduction to Expense Reduction Financial Services Solutions

ERA Group provide a wide range of industry solutions, with a variety of dedicated teams made up of experts from those industries. Here, Richard Placito, the chair of our Financial Services Industry Solutions group, provides a simple overview of how Expense Reduction Financial Services Solutions can help your business, including the common challenges we've been able to help our clients with already. To learn more about our Financial Services Solutions, download the full white paper now.

"To achieve a competitive and sustainable cost base, firms must find the right mix of tactical cost reduction solutions to drive short-term gains and more strategic initiatives to realise the transformational cost reductions needed to compete in the emerging Financial Services marketplace."

Financial Services Sector Industry Insights

Regulatory Compliance & Risk Management

Compliance has come under major scrutiny in recent years, triggered by escalating corporate guidelines with roots in the financial crisis of 2008. Regulators have introduced ever increasing numbers of compliance issues which organisations must conform to and bear the associated costs.

Technology

In the Financial Services sector today, the accelerating pace of technological change can be a creative force – but also a destructive one.

Every firm must embrace technology as it impacts every facet of the business. Artificial intelligence, robotics, big data and Blockchain are transforming the industry. Technology will determine which firms are the winners in a fast-changing landscape.

Customer Expectations

Both business and commercial users now expect a digital experience from their financial institutions. It’s about differentiated customer offerings, providing what customers want, when they want it, and how they want it, whether you’re a bank, insurer or asset manager. This isn’t just a matter of cosmetics. Organisations need to change their back-office operations to support it. And they will need to think differently about how to solve problems.

Harpenden Case Study

Please enter your email address to download this file.

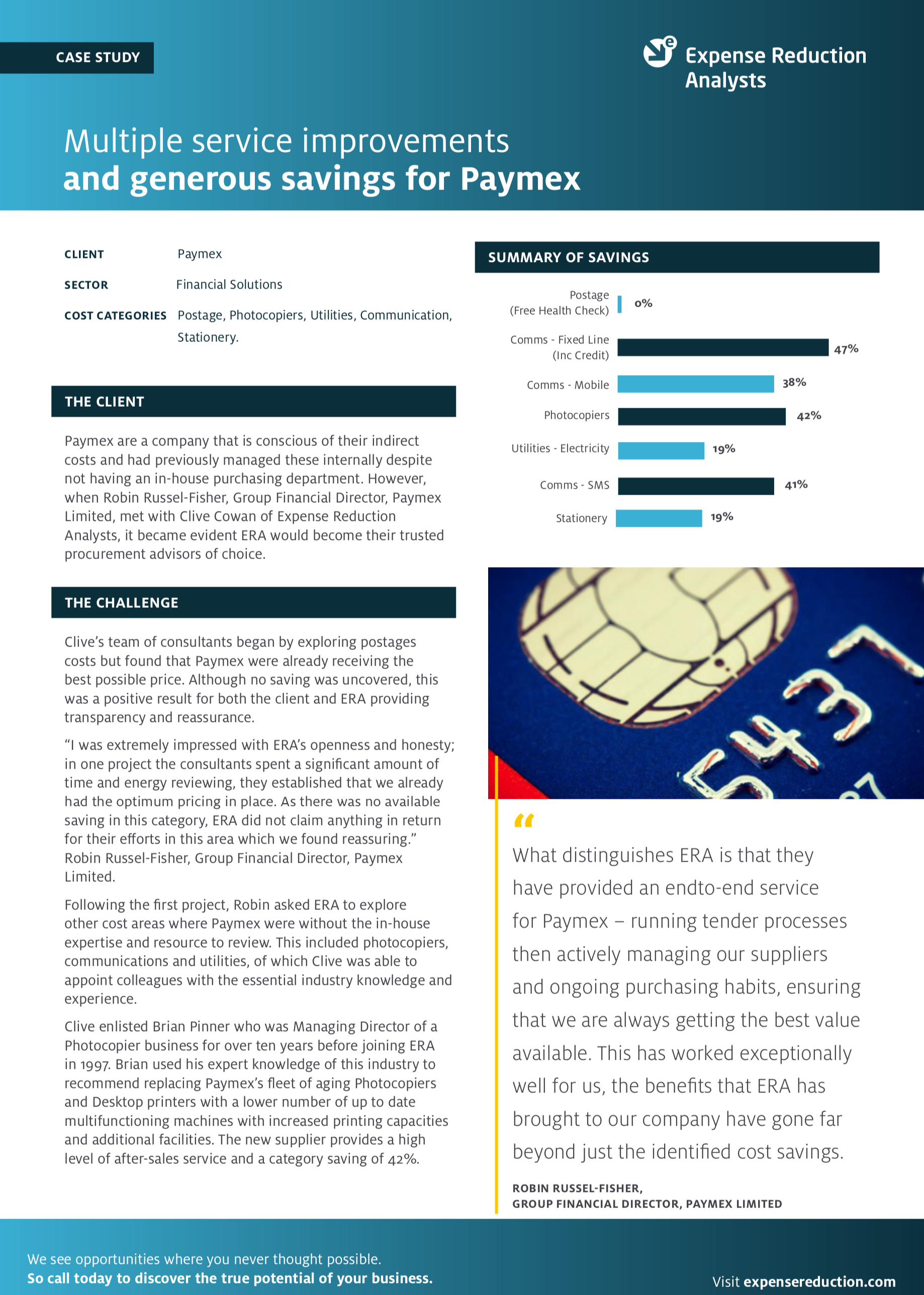

Paymex Case Study

Please enter your email address to download this file.