Transforming Working Capital in the Nordics is a Testament to the Transformative Power of Effective Working Capital Management.

Working capital has become more important. Organisations could optimise it through their payables, receivables, and inventory.

In an era where cash is king, working capital optimisation has emerged as the key to financial stability and growth for companies. A recent analysis by McKinsey of 250 large organisations headquartered in Denmark, Finland, Norway, and Sweden has unveiled a staggering €220 billion opportunity for those who master the art of managing their working capital effectively.

The Time Value of Money

In today’s world, cash isn’t just important; it’s existential. The changing economic landscape marked by rising interest rates, supply chain challenges, and increasing energy costs has brought the time value of money to the forefront. Companies have realised that they can’t afford to wait or run out of cash.

A Massive Opportunity in Working Capital

To grasp the magnitude of the opportunity, let’s break it down. McKinsey revealed, Nordic companies in the bottom quartile, based on the length of their cash conversion cycle, could release approximately €100 billion in cash by matching their median industry peers’ performance. But the real potential lies in lifting these bottom performers to the level of the top quartile, potentially unleashing a colossal €220 billion in cash reserves.

The Power of Optimisation

So, how can this transformation be achieved? The answer lies in optimising net working capital by focusing on payables, receivables, and inventory management. By doing so, companies can gain multiple advantages:

- Enhancing Credit Rating: Improved working capital can bolster credit ratings, enabling companies to borrow at lower costs.

- Investment Opportunities: With more cash on hand, businesses can explore new investments, boost operations, and even acquire valuable assets.

- Boosting Enterprise Value: Effective working capital management can significantly enhance a company’s overall value.

- Buffering Against Costs: As operating costs rise, having a cushion of cash can serve as a buffer, preventing financial strain.

The Impact of the Cash Conversion Cycle

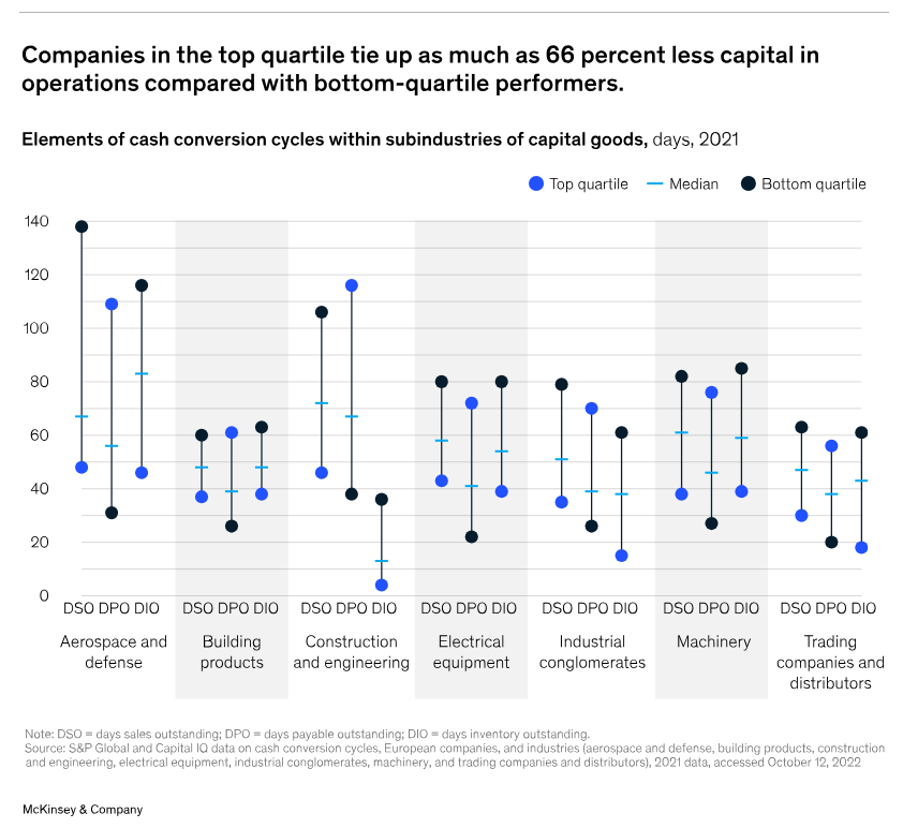

Analysing the cash conversion cycle – the time it takes to convert resources into cash from sales – reveals fascinating insights. Companies in the top quartile tie up significantly less capital in operations compared to their bottom-quartile counterparts. This means that working capital optimization isn’t just about matching peers but can lead to outperforming them by a substantial margin.

Cash conversion cycle = days sales outstanding (DSO)-days payables outstanding (DPO)+days inventory outstanding (DIO)

An industry-specific view of the elements of the cash conversion cycle suggests that top-quartile performers in each industry tie up 50 to 66 percent less capital in operations than their bottom-quartile counterparts in the same industry.

Strategies for Optimisation

The path to working capital optimisation is multifaceted:

- Inventory Management: With unpredictable global supply chains, companies must strike a balance between reducing inventory and optimising the mix of inventory items. It’s not just about reducing stock; it’s about managing it more efficiently. Done correctly, this can not only reduce inventory levels overall but also improve general availability by optimising the inventory mix. One industrial distributor identified an opportunity to reduce inventory by 25 percent and strengthened availability by introducing parameter-guided inventory management.

- Payables and Receivables: Managing payment terms with suppliers and customers becomes critical. Negotiating favourable terms and eliminating early payments can free up substantial cash reserves. We have access to the TermsCheck.com payment term database that can help compare the payment terms that you have agreed with your suppliers with the payment terms that those same suppliers have offered someone else.

This information is vital in determining how realistic payment term change can be and serves to challenge the naysayers who are always looking for excuses to keep the status quo. Many companies tolerate customers’ payment delays and suppliers’ quality and invoicing issues. Companies could recognise their roles as customers to their suppliers and strengthen relationships by using the power of the purse to enforce quality and invoicing expectations. We will help you to optimise payment runs including what day of the week is best to pay suppliers. We have developed mathematical formulas that can precisely determine the cash flow effect of paying on particular days of the week. We use your data to compute an exact result based on your payment history. - Collaboration and Governance: Cross-functional collaboration is key. Finance, procurement, and operations need to work together to optimise payables and receivables effectively. Establishing a dedicated control tower focused on cash can centralise efforts and ensure sustainability.

One global manufacturing company paired its finance and procurement functions to optimise its payables and receivables. The joint team’s analyses produced a staged plan to improve invoice handling and implement a supplier-financing offering. As a result, the company aims to reduce the amount of cash tied up in payables and receivables by 8 percent within 12 months.

ERA Working Capital Specialists: Your Allies in Financial Success

In an environment where every financial decision is crucial, companies must evolve their organisational habits to thrive. ERA’s working capital specialists offer invaluable support. We understand that working capital management is more than just numbers; it’s about securing your business’s future.

Our experts will help you:

- Optimise Treasury Actions: We’ll fine-tune your treasury strategies to bolster cashflow and financial stability.

- Enhance Procurement Efficiency: Streamlining procurement processes can unlock substantial savings and fortify your bottom line.

- Optimise Payments & Receivables: Efficient payment management can reduce costs and enhance working capital, strengthening your financial position.

- EBITDA Impact: The Ultimate Goal

At the heart of it all, working capital management directly influences EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation). By optimising treasury, procurement, and payment actions, businesses can enhance cashflow, reduce costs, and improve profitability. ERA’s working capital specialists are your trusted partners in achieving these critical objectives.

In the ever-shifting economic landscape, ERA’s working capital experts offer the expertise and strategies you need to thrive. Unlock your business potential today with ERA, where working capital matters more than ever.

In conclusion, working capital management isn’t just an abstract concept; it’s the lifeblood of business resilience and prosperity. The €220 billion opportunity in the Nordics is a testament to the transformative power of effective working capital management. Cash is indeed king, and those who master its management will reign supreme in the world of business.