This year’s Autumn Budget provides fleets and business drivers with a decidedly mixed bag. But before we look at the impact from the Autumn 2017 Budget, it is worth reminding ourselves of one of the key legislative changes due to be enforced next year, that was announced previously, namely Capital Allowances.

Previous Budget Announcement:

Capital Allowances

Writing down allowances (WDA’s), are based on a car’s CO2 with the current threshold being 130g/km. Any car above 130g/km is limited to 9% writing down allowance per annum (on a pooled basis) with cars between 76g/km and 130g/km having a 19% allowance per annum. For cars at 75g/km and under (termed Ultra Low Emission Vehicles – ULEVs), allowances are accelerated to 100% in the first year.

From April 2018 the 130g/km threshold is reducing to 110g/km and ULEV’s will be classed as cars with 50g/km or lower.

Therefore, for any business (leasing cars) that does not amend their car policy in terms of CO2 limits to cater for these lower thresholds, costs will increase in the form of higher lease rentals and loss of corporation tax allowances.

Autumn 2017 Budget:

Company Car Benefit in Kind (BIK)

From next April, company car BIK will be determined not solely by CO2 emissions but also by a new testing standard called Real Driving Emissions Step 2, or RDE2 for short.

RDE2 was not due to impact until 2021 and as such there are virtually no diesel cars currently capable of meeting this new emissions test.

RDE2 is an open road test of how closely a car’s ‘real world’ emissions of CO2, NOx and particulates match the results of the international rolling road test (called WLTP) that determines the official figures published by the manufacturer. RDE2 is being called ‘real world Euro 6’ because it reveals whether a car really does conform to Euro 6 in real life.

Unfortunately for fleets and drivers, there are no RDE2-compliant diesels to choose from yet. It will be 2021 before all diesels sold in Europe and the UK are mandated to have a Real Driving Emissions rating. Only those that remain within Euro 6 limits for CO2 and NOx during the open road test will pass RDE2. That will matter to company car drivers because RDE2-compliant diesels, when they become available, will be fully exempt from the diesel surcharge on company car tax – i.e. they will attract the same BIK percentage as a petrol car with the same CO2 emissions. In the meantime, the Budget controversially increased the current 3% diesel surcharge to 4% from next April for non-RDE2-compliant models.

Company car tax rates to 2021

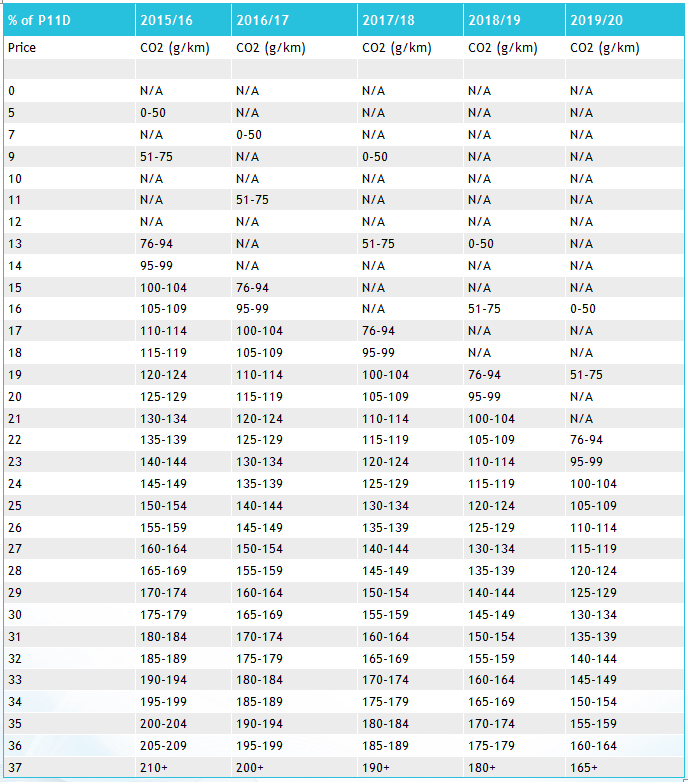

Except for the increase in the diesel surcharge from April, the Budget left company car BIK rates to 2021 unchanged:

Rates 2016-2020

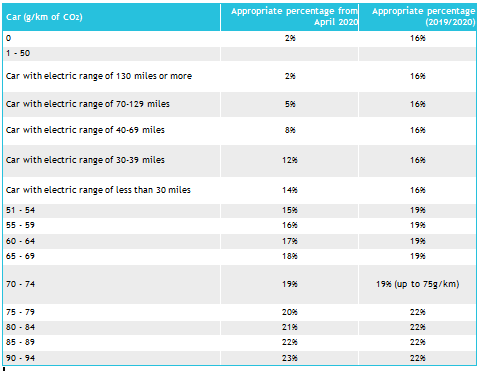

Low CO2 rates 2020-2021

Vehicle Excise Duty (VED)

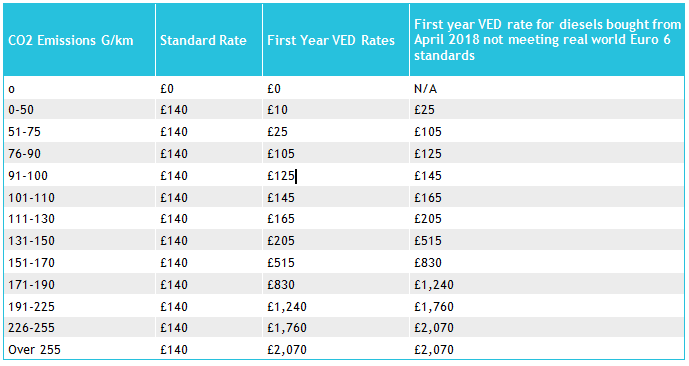

The Budget also ties VED on diesel cars to the Real Driving Emissions standard. All new diesel cars registered after 1 April 2018 that do not meet the RDE2 emissions standard will be subject to a supplement so that their First-Year Rate will be calculated as if they were in the VED band above. Examples range from an additional £20 on a typical Ford Focus diesel to a £400 increase on a Land Rover Discovery. The First Year VED band move will not apply to light and medium commercial vehicles, which will be subject to the RPI increase only. Vehicle Excise Duty rates for all cars, vans and motorcycles will increase by RPI from next April. The Heavy Goods Vehicle VED and Road User Levy rates will be frozen from 1 April 2018. To promote take-up of zero-emission capable taxis, the government will exempt them from the £310 VED supplement for expensive cars from April 2019.

New diesel VED bands from April 2018

Other Budget Measures Announced

- Company Van Benefit Charge: The taxable cash equivalent where a van is made available to an employee for private use will increase by 3.7% next April from the current £3,230 to £3,350.

- Company Car Fuel BIK: The multiplier for car fuel benefit-in-kind will increase by 3.5% next April from £22,600 to £23,400. The van fuel benefit charge will increase from £610 to £633.

- Charging private EVs at work: From April 2018, there will be no benefit in kind charge on electricity that employers provide to charge employees’ own electric vehicles. This rule already applies to plug-in company cars.

- Electric goods vehicle first year capital allowance: The 100% First Year Allowance (FYA) on zero-emission goods vehicles was due to end next March. The government will extend it for three years to 1 April 2021 together with the 100% FYA on installing refuelling equipment for natural gas, biogas and hydrogen vehicle.

- Fuel duty: The Budget announced that fuel duty will be frozen for an eighth successive year. Changes to fuel duty rates for alternative fuels will be announced in the next Budget. In the meantime, the government will end the fuel duty escalator for Liquefied Petroleum Gas (LPG), freezing it in 2018-19, alongside the main rate of fuel duty.

- Employee business expenses: Following a consultation earlier this year, the government will make several changes to the taxation of employee expenses. To reduce the burden on employers, from April 2019 they will no longer be required to check receipts when reimbursing employees’ subsistence claims using benchmark scale rates. The existing concessionary scale rates for accommodation and subsistence overseas will become statutory, to provide greater certainty for businesses.

Comment

It does seem puzzling and illogical that the new regime of taxing diesel engine vehicles (via BIK and first year VED) is being centred on new cars rather than those that are more polluting – after all it is the pre-Euro VI standard engines that are causing the harm. To then accelerate RDE2 test regulations to April 2018 when these are not even mandatory for manufacturers until 2020 does seem to be rubbing salt into the wound.

All of this and the previous tax actions already applied are substantially increasing the cost to the employee (and employer via National Insurance Contributions) in taking a company car. If people are unaware currently, it’s only a matter of time before irate employees are berating their HR departments asking where all the additional cost has come from. The changes are likely to be keenly felt:

- As an example, the BIK applied to a 99g/km diesel car (which is not even at the top end of the scale) is set to increase between 2016/17 and 2019/20 by 42%.

- To put that in context, for a car with a P11D value of £25,000 and for an employee in the 40% income tax rate bracket, they will see an increase of £700 per annum in monetary terms by 2020.

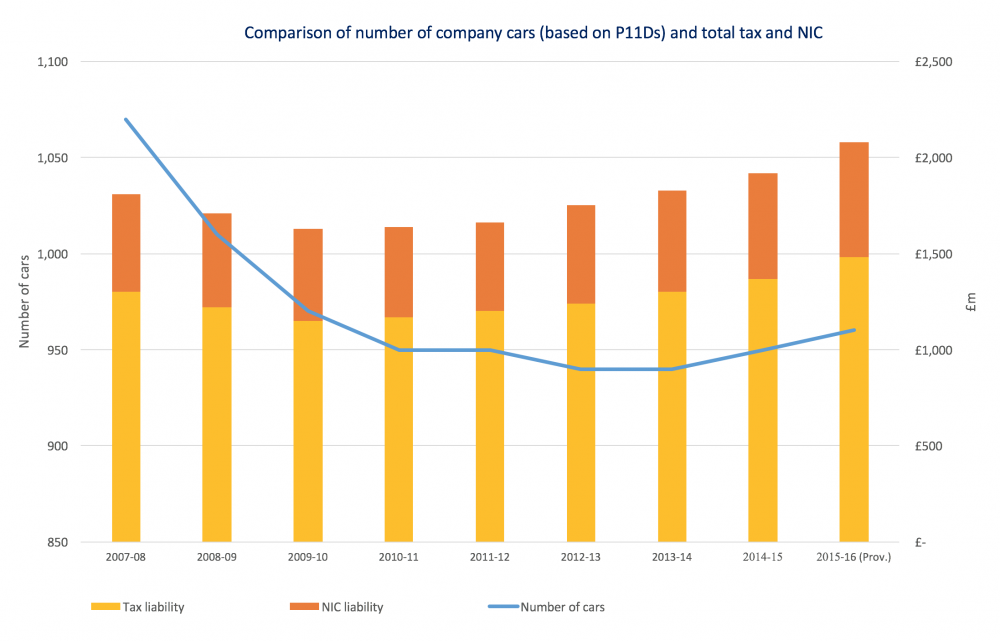

It seems to us a short sighted and irrational decision; especially in a market where new car sales are expected to fall for the first time since 2011. It certainly doesn’t appear to address the fundamental issues of emissions and climate change and rather seems designed only to address the shortfall in tax revenue. Ten years ago, the total number of company cars in Britain was more than a million; today there are around 100,00 fewer than that. If you want to understand the true extent to which the taxation has increased for employers and employees consider this: the government will take around 12% more from taxation and NIC from 11% fewer cars under this scheme, than they were taking ten years ago.

The graph below shows this disparity between total cars and tax revenues.

Source: HRUX

The increasing cost and complexity in operating company cars is why UK business should be constantly assessing and reviewing car policies. The landscape is complicated, constantly changing and in many cases, counter-intuitive, as we have seen.

In order to manage your fleet operations for maximum benefit and minimum cost to you and your employees, contact us at ERA Fleet Cost Management for some impartial advice from knowledgeable experts.