This month in our series on e-commerce, we take our first look at the role of the Payments industry.

In the next article, we’ll share some insights into how to achieve best value for e-commerce payment solutions. First though, some background on how the industry works, and what challenges need to be considered – and when.

The e-commerce market in the UK is the largest in Europe, however after being early adopters, growth is now steady rather than exponential. Smartphone penetration and internet access though, are both comparatively high and new forms of payment are starting to gain a foothold.

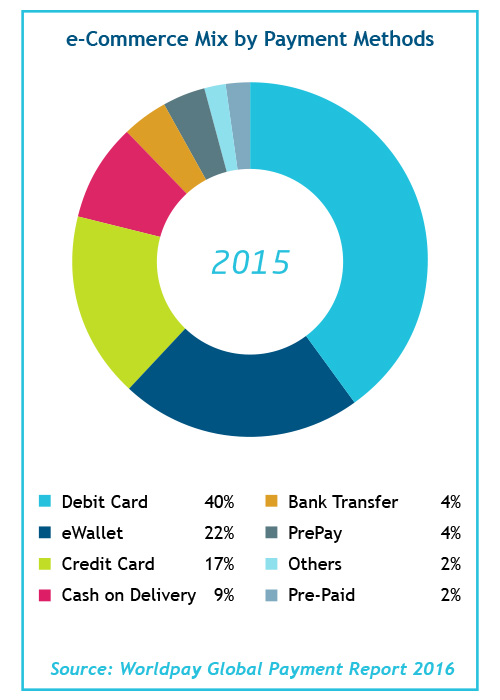

This means that sensible retailers will offer a range of payment options within the e-commerce environment. The proportion of payments from credit and debit cards is set to decline over the next few years from the current high of 57% of the growing market.

That still leaves 43% of the market, so consideration must be given by retailers to the provision of other types of payment options, including eWallets, such as PayPal, Apple Pay and Google Wallet, which is set for the highest growth. Pre-pay, cash on delivery and Bank Transfer are well established and growing in other international markets.

Independent researchers Ovum predicts that online card payments are topping out around now and any growth in volumes of payments will be picked up by the newer, instant payment technologies like Android & Apple Pay. The direction of travel then, is clear. Any organisation taking electronic payments, online or via mobile in future, needs to respond to the needs of their consumers.

So what’s required?

To link payment to a website or mobile app, you need two things: a ‘bank’ and a ‘gateway’. Your ‘bank’ is not normally your regular bank, but a provider of these services, such as Worldpay or Barclaycard, or alternatives like PayPal. The ‘gateway’ (Sage Pay, Cybersource, etc.) links the banks to the website or mobile app and provides the ‘look and feel’ of the payments process, as well as linking to your IT system.

And what’s expected?

With basic requirements covered, what else do your customers expect? Some eWallet transactions are driven by circumstance – iTunes or Android Store payments, or in-app purchases for example – though some are deliberate choices – such as preferring to use PayPal to a debit card on Amazon.

Whether buying services or physical goods consumers demand options; whilst the wider take-up of these technologies has not been as swift as some predicted outside those walled gardens, it is set to rise. Mobile usage is rising steadily in younger demographics for low cost/high volume transactions.

Global reach

E-commerce enables sales into international markets, though there are nuances to be aware of when exploring new territories. In some markets, credit cards are considered elitist. Whilst that works for elite brands, others will have to provide alternate payment options. Within Europe some countries already use bank transfer for more than 70% of online payments.

So who decides?

Traditionally these calls have been made by Finance – because it’s money – or IT / Marketing – because the website is their project.

When these decisions should be taken is also important; often IT & Marketing will choose a website platform or solution that ties them into a specific provider, leaving the Finance team with a fait accompli that can increase back-office costs. Often using multiple providers leads to customer experience being very different online, on mobile or instore. Payment solutions should be researched and decided upon during scoping discussions at the project outset, in order to enable the best commercial decisions.

Next time

In the next issue, we’ll delve deeper into all of these issues and give you some practical ideas and methods that will allow you to work from a position of more knowledge. We’ll look in more detail at customer expectations, options for different markets (e-commerce, m-commerce and bricks and mortar), security and risk, and ultimately, how to achieve best value for your payments solution.

For more information, please contact us.

Article by: The Banking & Payments Team